Browsing the Intricacies of Forex Trading: How Brokers Can Assist You Remain Informed and Make Informed Decisions

In the hectic world of forex trading, staying educated and making educated choices is necessary for success. Brokers play a crucial duty in this detailed landscape, supplying knowledge and assistance to navigate the complexities of the marketplace. Exactly how precisely do brokers assist investors in remaining in advance of the contour and making educated choices? By exploring the ways brokers provide market analysis, understandings, threat monitoring techniques, and technological tools, traders can gain a much deeper understanding of how to effectively leverage these sources to their benefit.

Duty of Brokers in Forex Trading

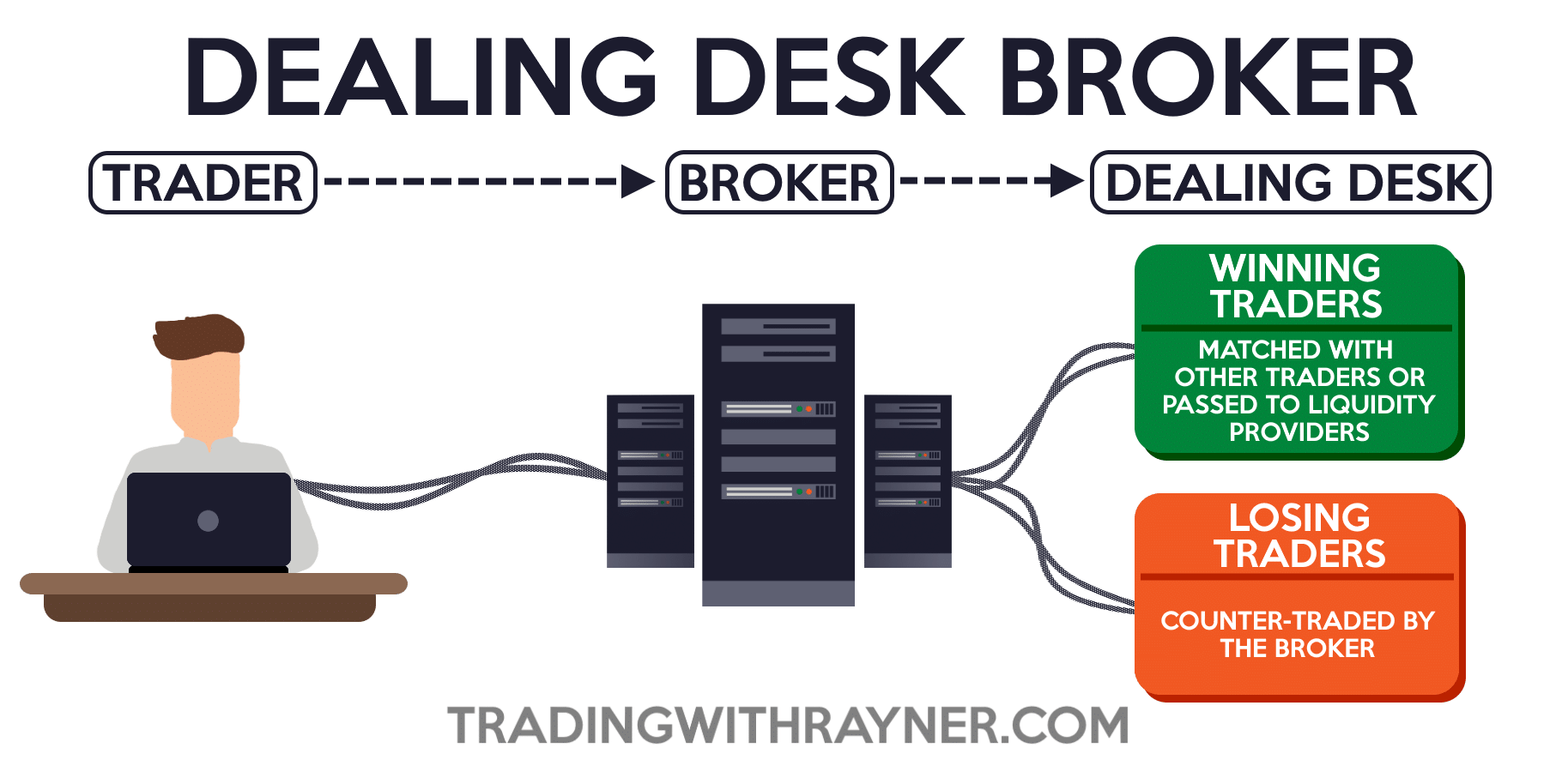

In the realm of Forex trading, brokers play a critical role as middlemans promoting deals in between traders and the international money market. forex brokers. These financial specialists act as a bridge, attaching individual investors with the large and complex globe of fx. Brokers give a platform for investors to access the market, offering devices, sources, and market understandings to help in making informed trading choices

Via the broker's trading system, investors can get and offer currency pairs in real-time, taking advantage of market fluctuations. This feature can intensify both losses and earnings, making threat administration a critical facet of trading with brokers.

In addition, brokers supply useful academic resources and market evaluation to aid investors browse the intricacies of Forex trading. By staying educated concerning market fads, financial signs, and geopolitical occasions, investors can make strategic choices with the guidance and support of their brokers.

Market Analysis and Insights

Providing a deep dive into market trends and providing useful understandings, brokers outfit investors with the essential devices to browse the elaborate landscape of Forex trading. Market analysis is an essential element of Foreign exchange trading, as it includes analyzing different variables that can influence money rate movements. Brokers play a pivotal function in this by offering traders with updated market analysis and understandings based upon their know-how and research study.

Through technical analysis, brokers assist investors recognize historical cost data, recognize patterns, and predict possible future price activities. Additionally, basic evaluation allows brokers to evaluate financial signs, geopolitical events, and market information to evaluate their influence on money values. By manufacturing this info, brokers can supply traders beneficial insights into possible trading opportunities and dangers.

Moreover, brokers commonly provide market reports, newsletters, and real-time updates to keep traders informed regarding the latest advancements in the Foreign exchange market. This continuous flow of info makes it possible for traders to make knowledgeable choices and adapt their approaches to changing market conditions. Generally, market evaluation and understandings supplied by brokers are vital devices that encourage investors to browse the vibrant globe of Foreign exchange trading properly.

Risk Management Techniques

Navigating the unpredictable terrain of Foreign exchange trading necessitates the implementation of robust risk administration methods. In the globe of Foreign exchange, where market variations can happen in the blink of an eye, having a solid risk management plan is essential to securing your investments. One crucial method is setting stop-loss orders to immediately close a trade when it reaches a specific undesirable cost, limiting prospective losses. Furthermore, diversifying your portfolio across various money sets and possession classes can help spread threat and protect versus substantial losses from a solitary profession.

Remaining notified about global financial events and market news can help you anticipate possible risks and adjust your trading strategies as necessary. Eventually, a regimented method to take the chance of management is crucial for long-term success in Foreign exchange trading.

Leveraging Modern Technology for Trading

To effectively browse the intricacies of Forex trading, using innovative technical tools and systems is vital for maximizing trading methods and decision-making procedures. In today's fast-paced and vibrant market environment, investors rely greatly on technology to obtain an affordable edge. Among the key technical innovations that have transformed the Foreign exchange trading landscape is the development of trading platforms. These systems offer real-time information, progressed charting tools, and automated trading capabilities, enabling traders to implement professions successfully and react rapidly to market movements.

Furthermore, mathematical trading, additionally referred to as automated trading, has actually ended up being increasingly prominent in the Foreign exchange market. By utilizing algorithms to examine market problems and carry out trades immediately, traders can remove human emotions from the decision-making process and capitalize on chances that emerge within nanoseconds.

Additionally, making use of mobile trading apps has encouraged investors to remain linked to the market in all times, allowing them to monitor their settings, receive signals, and place professions on the go. Generally, leveraging technology in Foreign exchange trading not only boosts read efficiency yet also gives investors with useful insights and tools to make informed decisions in a very competitive market atmosphere.

Developing a Trading Strategy

Crafting a well-defined trading plan is crucial for Forex investors aiming to navigate the intricacies of the marketplace with precision and critical insight. A trading strategy functions as a roadmap that outlines a trader's objectives, risk resistance, trading strategies, and strategy to decision-making. It assists traders maintain technique, take care of emotions, and stay concentrated on their objectives amidst the ever-changing dynamics of the Foreign exchange market.

Conclusion

To conclude, brokers play an important function in helping investors navigate the complexities of forex trading by providing market analysis, understandings, risk management approaches, and leveraging technology for trading. Their experience and assistance can help investors in making educated decisions and establishing efficient trading strategies. forex brokers. By working with brokers, traders can stay notified and raise their chances of success in the forex market

Comments on “Forex Brokers: Protect and Reliable Options for Traders”